español

Get Started

español

Get Started

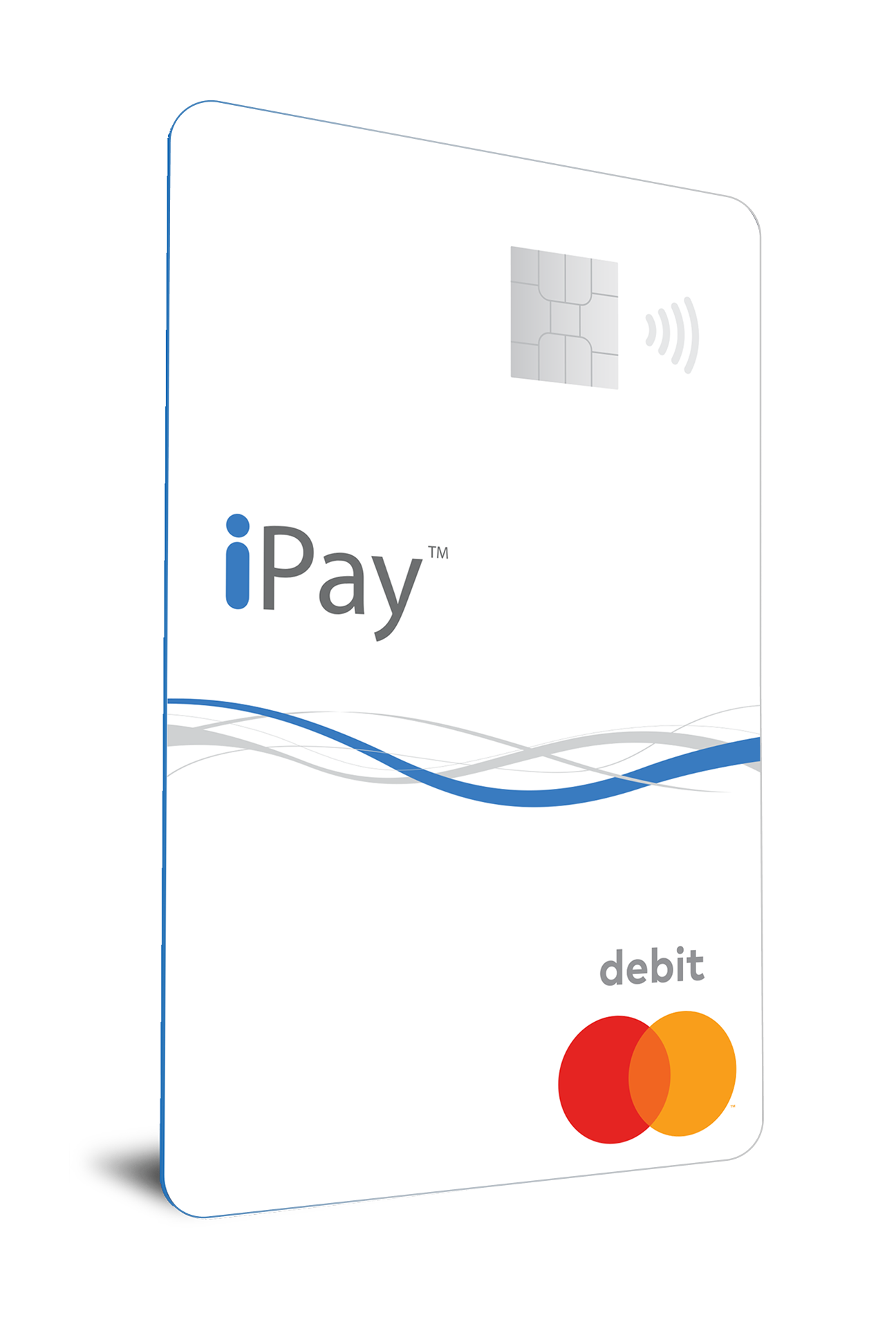

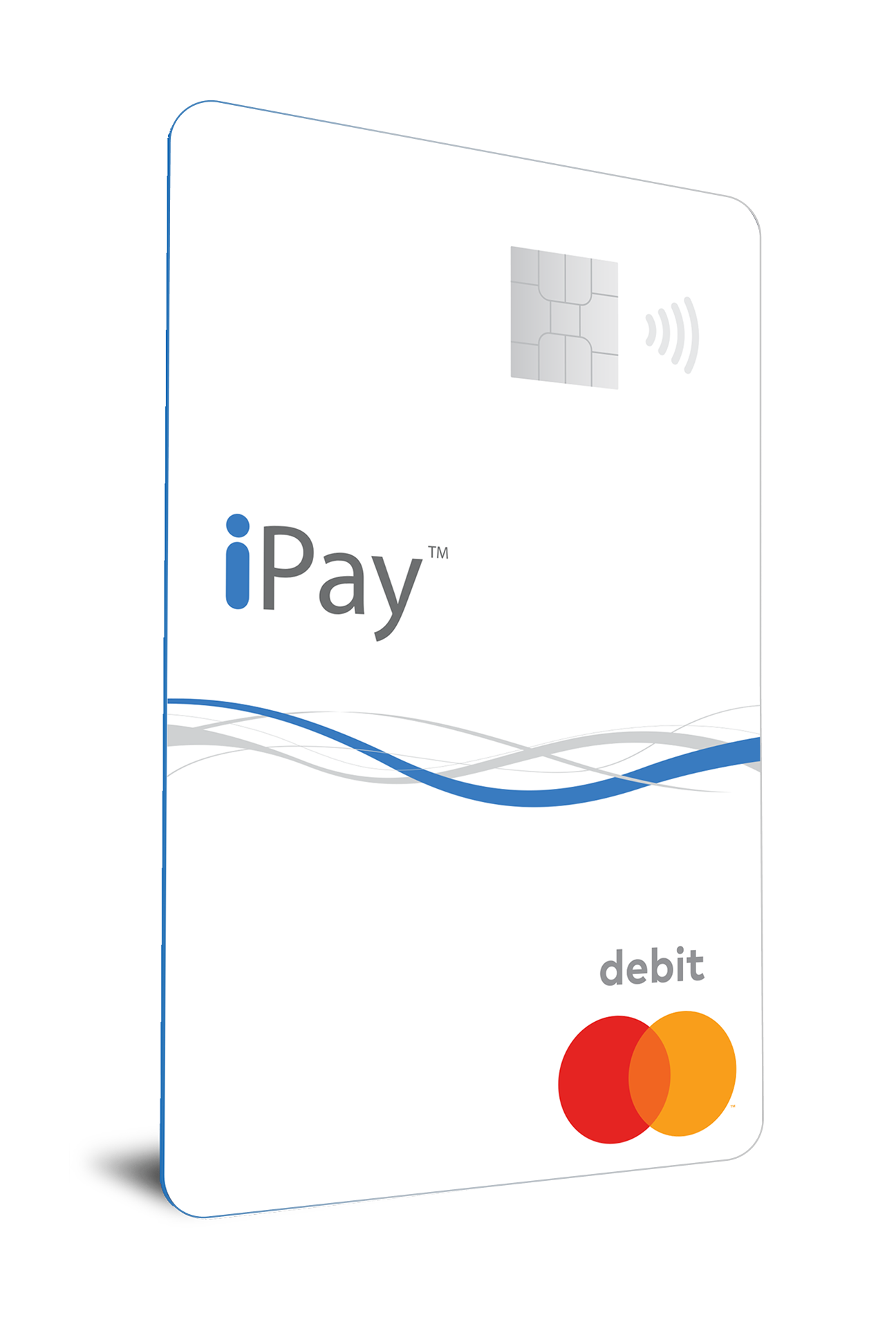

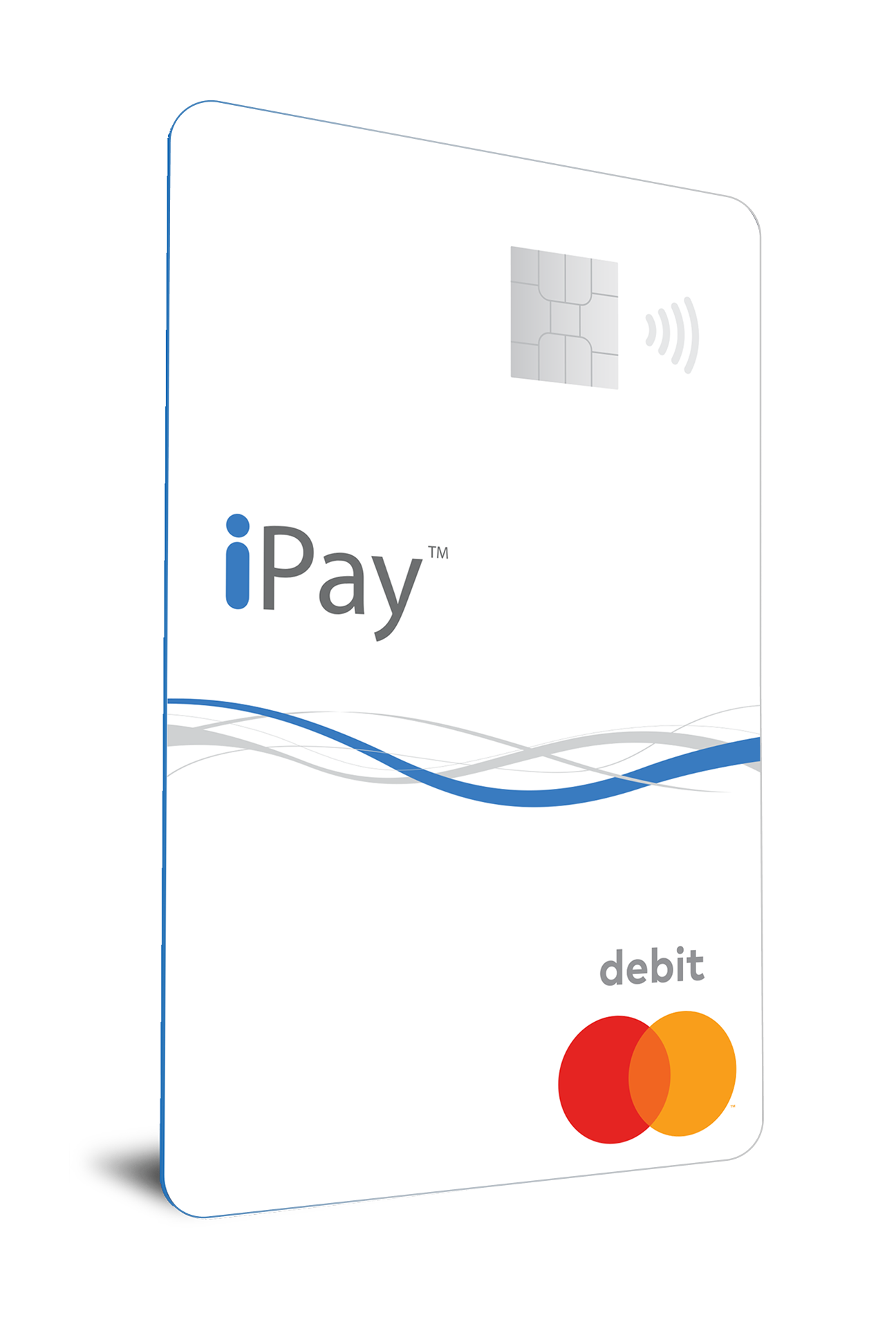

iPay Payroll Mastercard®

Your Money,

Your Way.

Use Anywhere

Shop online, in-store, or over the phone—anywhere Debit Mastercard® is accepted, and you won’t be held responsible for unauthorized purchase with Mastercard Zero Liability* policy.

Tap. Pay. Done.

Tap with your card for quick, secure, hassle-free contactless payments.

More Secure Way to Pay

Your new card now features greater fraud protection with EMV® Chip technology—built right in.

Amazing Service

Get friendly, personalized service from our dedicated in-house bilingual service team—real people who always go the extra mile for you.

Your Money On The Go.

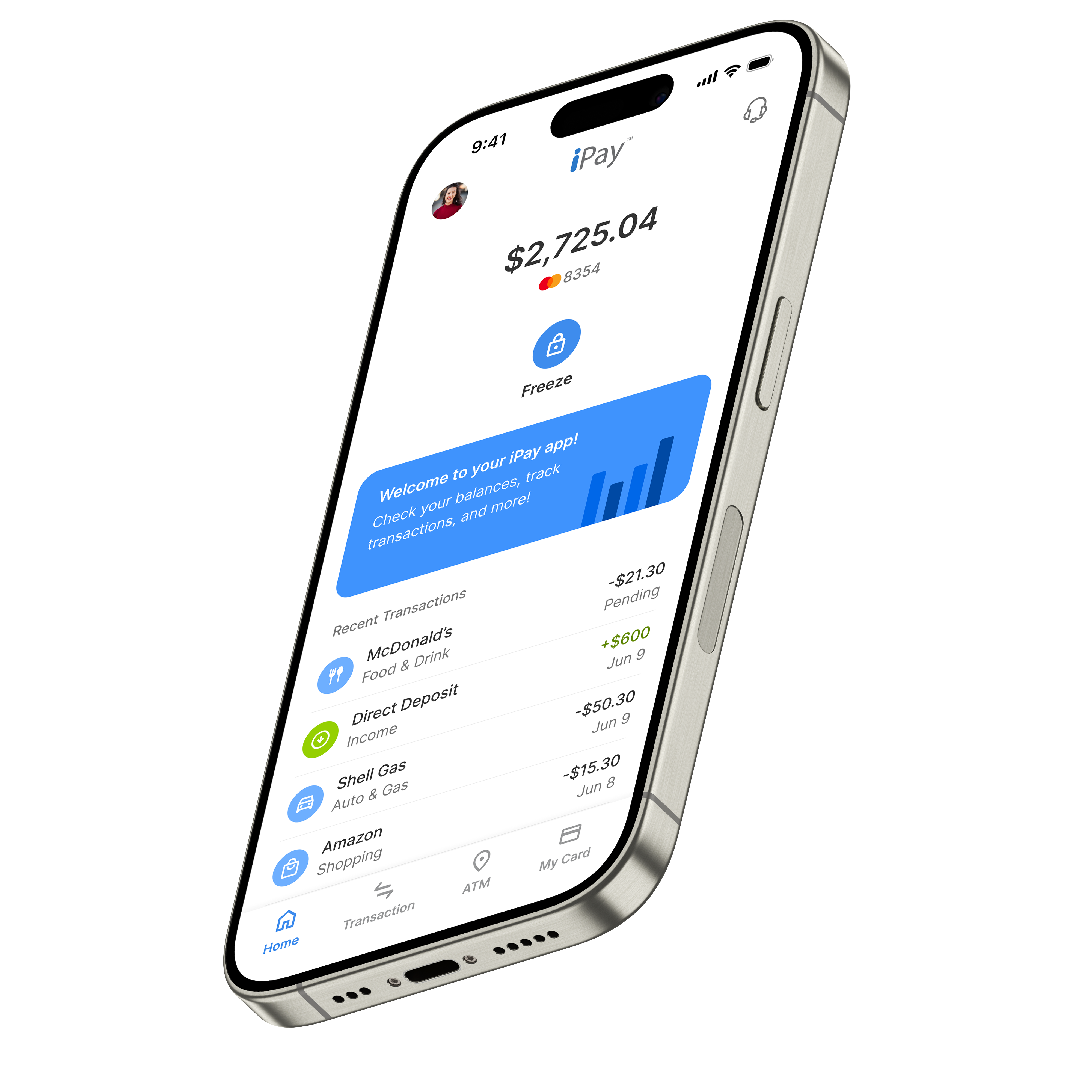

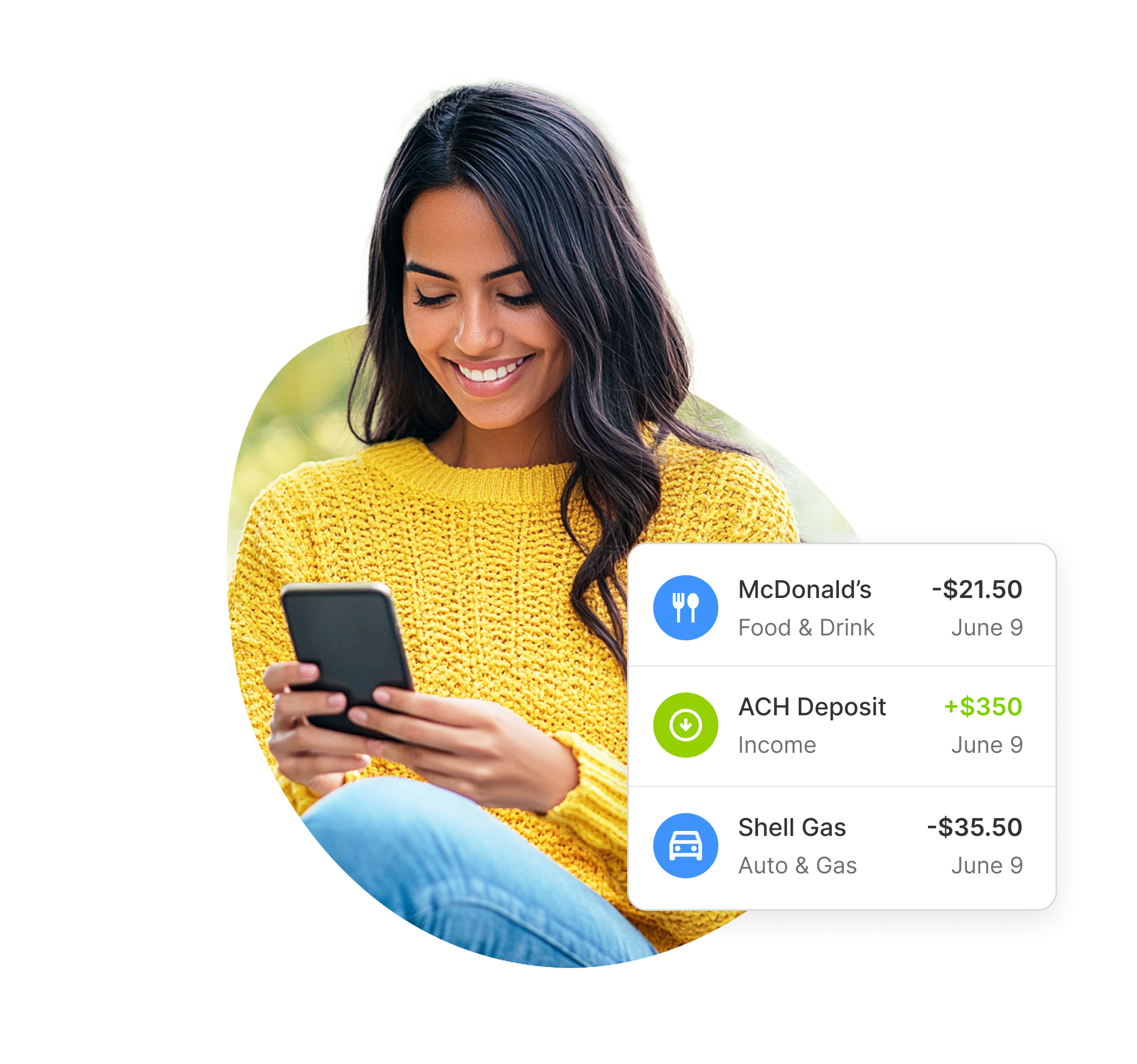

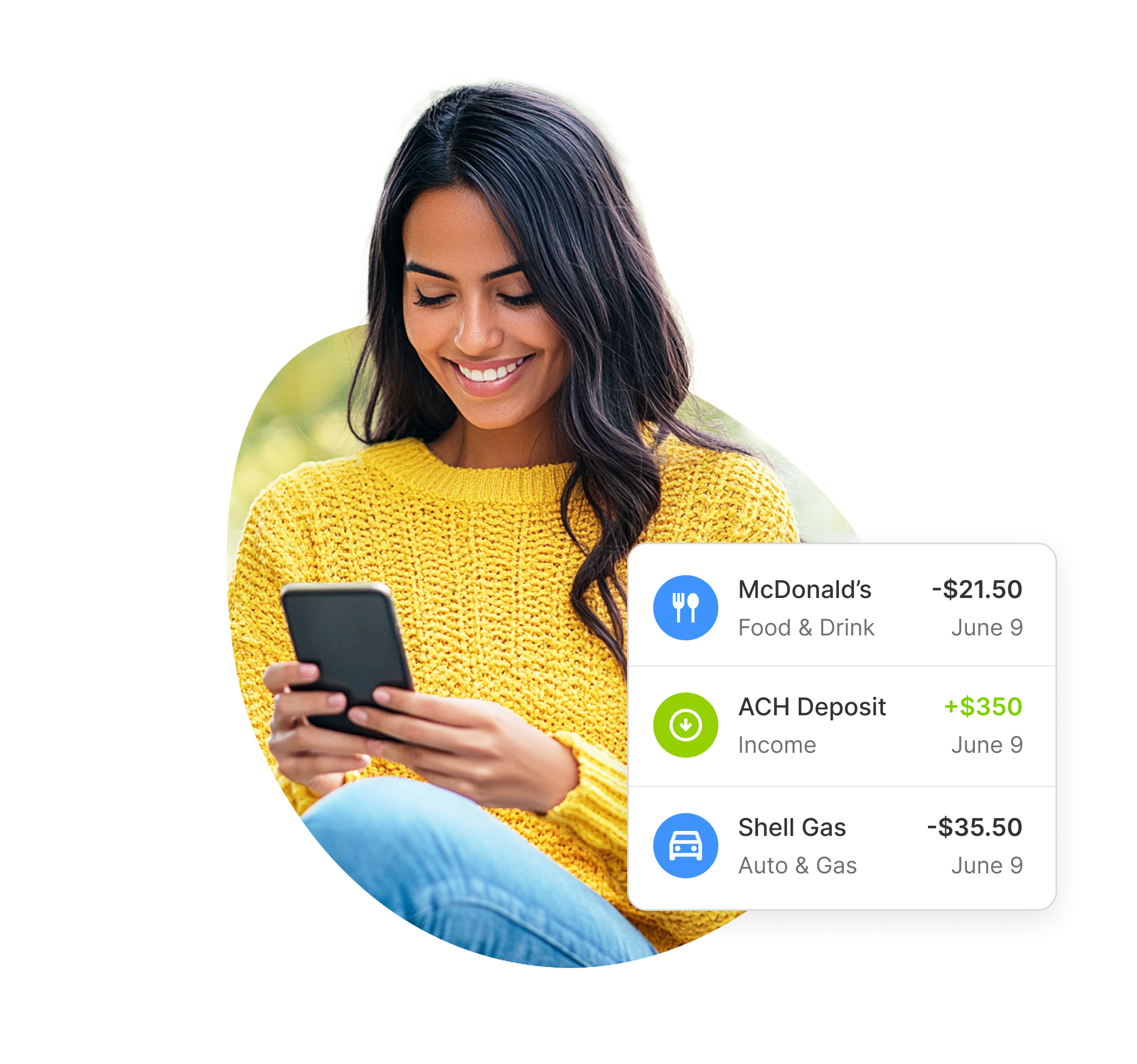

Mobile Banking

Manage your accounts, check balances, track spending, and more—smart, digital banking on the go.

Download iPay App

Experience A Better Payday

Take control of your finances with a seamless, secure digital banking experience.

I use the iPay app almost every day—it’s super easy to check my balance and freeze my card if I misplace it. Total game changer.

— Kimberly W., Houston, TX

Tap N’ Go is my favorite! Paying at the store is way faster now, and I love not having to carry cash.

— Jasmine T., Atlanta, GA

I got my paycheck faster with direct deposit and didn’t even need to go to the bank. The app does it all!

— Marcus R., San Diego, CA

How It Works

Three easy steps to receive a better payday.

1. Enroll Through Your Employer

Sign up for your iPay card through your employer – it only takes a minute.

2. Get Your Card & Get Paid

Instantly receive your iPay card, and your pay will automatically be deposited, every payday.

3. Use It Your Way

Make purchases, pay bills, get cash—and manage your money on the go.

Bonus Tip: You can add more money to your card through Green Dot® load services or other options provided by the card issuer.

Frequently Asked Questions

Got more questions? Reach out to us today!

How do I get an iPay Card?

How do I activate my iPay Card?

How can I check the balance on my iPay Card?

Can I use my iPay Card at ATMs?

When making purchases, should I choose Debit or Credit?

How do I make Cash App or Venmo transactions?

Can I use my iPay Card for gas purchases and “pay at the pump?”

Can I load additional funds to the iPay Card?

What happens if I leave my current employer?

Can I get a personalized iPay Card with my name?

What do I do if my iPay Card is lost or stolen?

Are there any fees for using my Card?

Say Hello to a

Better Payday

Overview

Support

Powered by

The iPay Payroll Mastercard is issued by SouthState Bank, N.A., pursuant to license by Mastercard®. This card is administered by Kurensē, a financial technology company. Your funds are FDIC insured up to $250,000 through SouthState Bank, N.A., Member FDIC.

IMPORTANT INFORMATION FOR OPENING A CARD OR DEPOSIT ACCOUNT: To help the federal government fight the funding of terrorism and money laundering activities, the USA PATRIOT Act requires us to obtain, verify, and record information that identifies each person who opens an Account. WHAT THIS MEANS FOR YOU: When you open an Account, we will ask for your name, address, date of birth, and your government ID number. We may also ask to see a copy of your driver’s license or other documents at any time. All Accounts are opened subject to our ability to verify your identity by requiring acceptable types of identification. We may validate the information you provide us to ensure we have a reasonable belief of your identity. If we are not able to verify your identity to our satisfaction, we will not open your Account or we may close the Account if it was previously funded. Your Account is subject to fraud prevention restrictions at any time, with or without notice.

No credit check, activation fee, or minimum balance required. Other transaction fees and costs, terms, and conditions are associated with the use of this Card or Account. See the Cardholder Agreement for more details.

Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Google Play and the Google Play logo are trademarks of Google LLC.

Apple® and the Apple logo® are trademarks of Apple Inc., registered in the U.S. and other countries.

The App Store is a registered trademark of Apple Inc.

Copyright © 2025 Kurensē, Inc. All rights Reserved.

español

Get Started

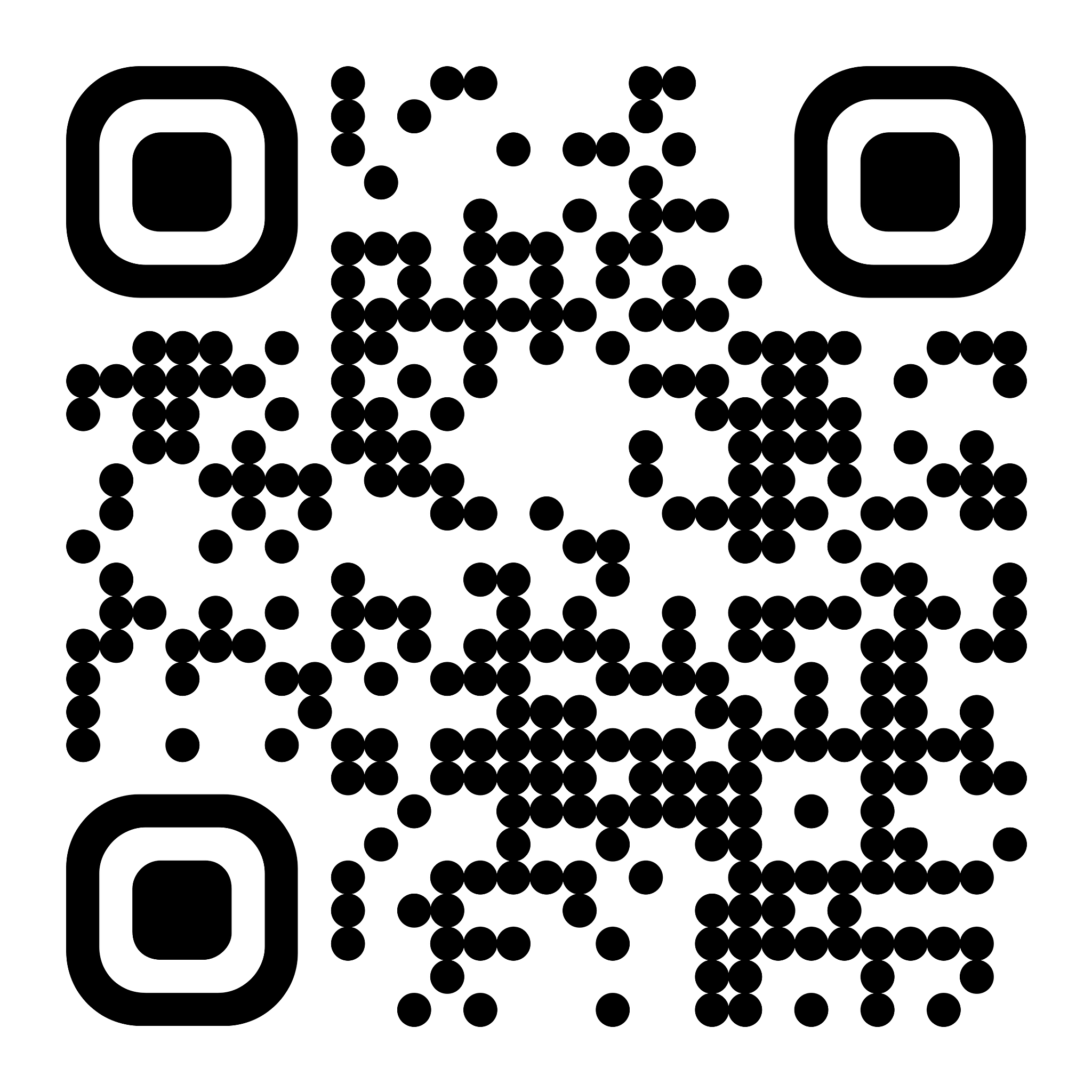

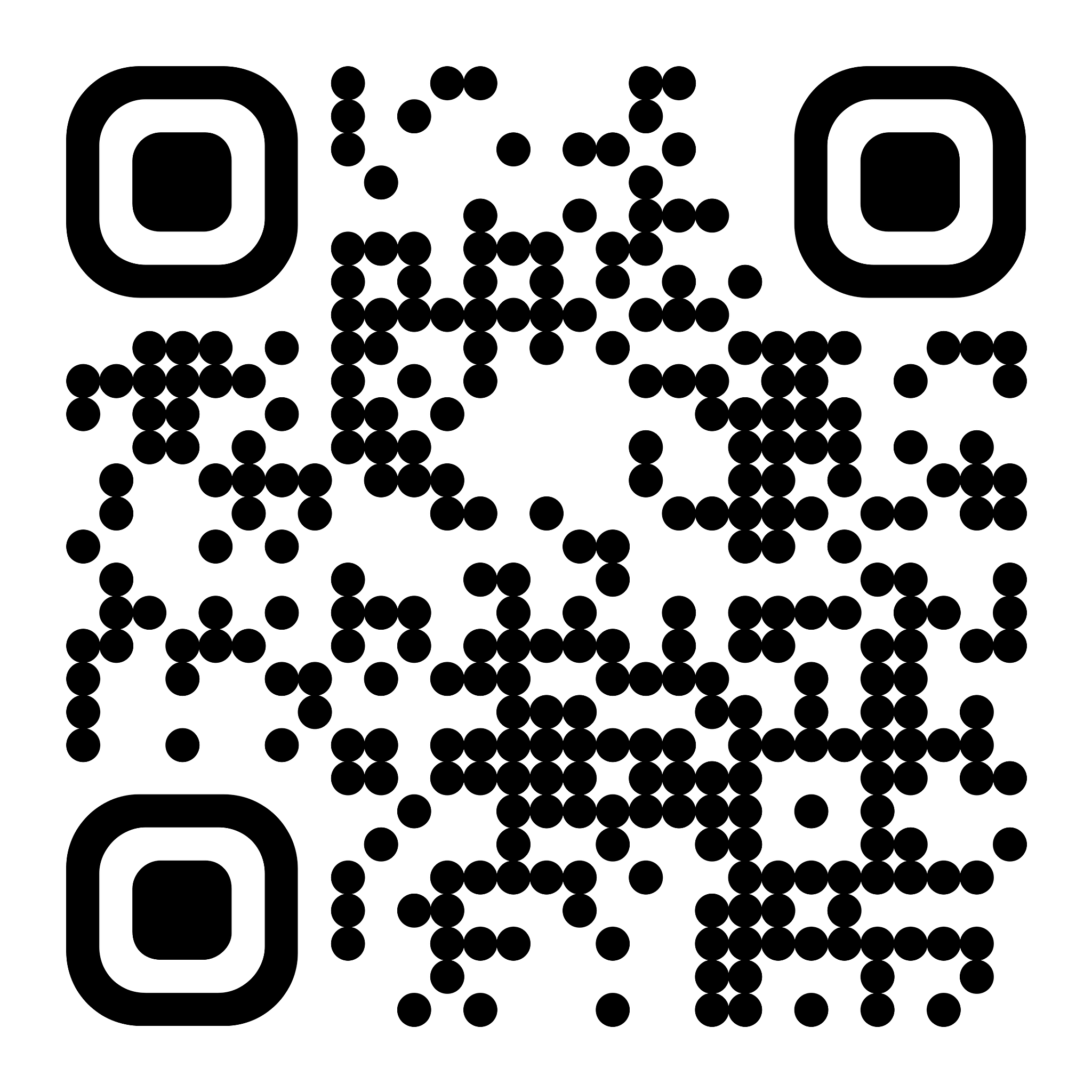

Scan to Get iPay App

español

Get Started

iPay Payroll Mastercard®

Your Money, Your Way.

Use Anywhere

Shop online, in-store, or over the phone—anywhere Debit Mastercard® is accepted, and you won’t be held responsible for unauthorized purchase with Mastercard Zero Liability* policy.

Tap. Pay. Done.

Tap with your card for quick, secure, hassle-free contactless payments.

More Secure Way to Pay

Your new card now features greater fraud protection with EMV® Chip technology—built right in.

Amazing Service

Get friendly, personalized service from our dedicated in-house bilingual service team—real people who always go the extra mile for you.

Your Money On The Go.

Mobile Banking

Manage your accounts, check balances, track spending, and more—smart, digital banking on the go.

Download iPay App

Experience A Better Payday

Take control of your finances with a seamless, secure digital banking experience.

I use the iPay app almost every day—it’s super easy to check my balance and freeze my card if I misplace it. Total game changer.

— Kimberly W., Houston, TX

Tap N’ Go is my favorite! Paying at the store is way faster now, and I love not having to carry cash.

— Jasmine T., Atlanta, GA

I got my paycheck faster with direct deposit and didn’t even need to go to the bank. The app does it all!

— Marcus R., San Diego, CA

How It Works

Three easy steps to receive a better payday.

1. Enroll Through Your Employer

Sign up for your iPay card through your employer – it only takes a minute.

2. Get Your Card & Get Paid

Instantly receive your iPay card, and your pay will automatically be deposited, every payday.

3. Use It Your Way

Make purchases, pay bills, get cash—and manage your money on the go.

Bonus Tip: You can add more money to your card through Green Dot® load services or other options provided by the card issuer.

Frequently Asked Questions

Got more questions? Reach out to us today!

How do I get an iPay Card?

How do I activate my iPay Card?

How can I check the balance on my iPay Card?

Can I use my iPay Card at ATMs?

When making purchases, should I choose Debit or Credit?

How do I make Cash App or Venmo transactions?

Can I use my iPay Card for gas purchases and “pay at the pump?”

Can I load additional funds to the iPay Card?

What happens if I leave my current employer?

Can I get a personalized iPay Card with my name?

What do I do if my iPay Card is lost or stolen?

Are there any fees for using my Card?

Say Hello to a

Better Payday

Overview

Support

Powered by

The iPay Payroll Mastercard is issued by SouthState Bank, N.A., pursuant to license by Mastercard®. This card is administered by Kurensē, a financial technology company. Your funds are FDIC insured up to $250,000 through SouthState Bank, N.A., Member FDIC.

IMPORTANT INFORMATION FOR OPENING A CARD OR DEPOSIT ACCOUNT: To help the federal government fight the funding of terrorism and money laundering activities, the USA PATRIOT Act requires us to obtain, verify, and record information that identifies each person who opens an Account. WHAT THIS MEANS FOR YOU: When you open an Account, we will ask for your name, address, date of birth, and your government ID number. We may also ask to see a copy of your driver’s license or other documents at any time. All Accounts are opened subject to our ability to verify your identity by requiring acceptable types of identification. We may validate the information you provide us to ensure we have a reasonable belief of your identity. If we are not able to verify your identity to our satisfaction, we will not open your Account or we may close the Account if it was previously funded. Your Account is subject to fraud prevention restrictions at any time, with or without notice.

No credit check, activation fee, or minimum balance required. Other transaction fees and costs, terms, and conditions are associated with the use of this Card or Account. See the Cardholder Agreement for more details.

Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Google Play and the Google Play logo are trademarks of Google LLC.

Apple® and the Apple logo® are trademarks of Apple Inc., registered in the U.S. and other countries.

The App Store is a registered trademark of Apple Inc.

Copyright © 2025 Kurensē, Inc. All rights Reserved.

español

Get Started

Scan to Get iPay App

español

Get Started

iPay Payroll Mastercard®

Your Money, Your Way.

Use Anywhere

Shop online, in-store, or over the phone—anywhere Debit Mastercard® is accepted, and you won’t be held responsible for unauthorized purchase with Mastercard Zero Liability* policy.

Tap. Pay. Done.

Tap with your card for quick, secure, hassle-free contactless payments.

More Secure Way to Pay

Your new card now features greater fraud protection with EMV® Chip technology—built right in.

Amazing Service

Get friendly, personalized service from our dedicated in-house bilingual service team—real people who always go the extra mile for you.

Your Money On The Go.

Mobile Banking

Manage your accounts, check balances, track spending, and more—smart, digital banking on the go.

Download iPay App

Experience A Better Payday

Take control of your finances with a seamless, secure digital banking experience.

I use the iPay app almost every day—it’s super easy to check my balance and freeze my card if I misplace it. Total game changer.

— Kimberly W., Houston, TX

Tap N’ Go is my favorite! Paying at the store is way faster now, and I love not having to carry cash.

— Jasmine T., Atlanta, GA

I got my paycheck faster with direct deposit and didn’t even need to go to the bank. The app does it all!

— Marcus R., San Diego, CA

How It Works

Three easy steps to receive a better payday.

1. Enroll Through Your Employer

Sign up for your iPay card through your employer – it only takes a minute.

2. Get Your Card & Get Paid

Instantly receive your iPay card, and your pay will automatically be deposited, every payday.

3. Use It Your Way

Make purchases, pay bills, get cash—and manage your money on the go.

Bonus Tip: You can add more money to your card through Green Dot® load services or other options provided by the card issuer.

Frequently Asked Questions

Got more questions? Reach out to us today!

How do I get an iPay Card?

How do I activate my iPay Card?

How can I check the balance on my iPay Card?

Can I use my iPay Card at ATMs?

When making purchases, should I choose Debit or Credit?

How do I make Cash App or Venmo transactions?

Can I use my iPay Card for gas purchases and “pay at the pump?”

Can I load additional funds to the iPay Card?

What happens if I leave my current employer?

Can I get a personalized iPay Card with my name?

What do I do if my iPay Card is lost or stolen?

Are there any fees for using my Card?

Say Hello to a

Better Payday

Overview

Support

Powered by

The iPay Payroll Mastercard is issued by SouthState Bank, N.A., pursuant to license by Mastercard®. This card is administered by Kurensē, a financial technology company. Your funds are FDIC insured up to $250,000 through SouthState Bank, N.A., Member FDIC.

IMPORTANT INFORMATION FOR OPENING A CARD OR DEPOSIT ACCOUNT: To help the federal government fight the funding of terrorism and money laundering activities, the USA PATRIOT Act requires us to obtain, verify, and record information that identifies each person who opens an Account. WHAT THIS MEANS FOR YOU: When you open an Account, we will ask for your name, address, date of birth, and your government ID number. We may also ask to see a copy of your driver’s license or other documents at any time. All Accounts are opened subject to our ability to verify your identity by requiring acceptable types of identification. We may validate the information you provide us to ensure we have a reasonable belief of your identity. If we are not able to verify your identity to our satisfaction, we will not open your Account or we may close the Account if it was previously funded. Your Account is subject to fraud prevention restrictions at any time, with or without notice.

No credit check, activation fee, or minimum balance required. Other transaction fees and costs, terms, and conditions are associated with the use of this Card or Account. See the Cardholder Agreement for more details.

Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Google Play and the Google Play logo are trademarks of Google LLC.

Apple® and the Apple logo® are trademarks of Apple Inc., registered in the U.S. and other countries.

The App Store is a registered trademark of Apple Inc.

Copyright © 2025 Kurensē, Inc. All rights Reserved.